Financial Sector Overhaul 2026

In late 2025, banks that used AI-driven predictive analytics increased their lead conversion rates by up to 30% by using data insights to create targeted sales strategies, but only 43% of banks around the world have started using AI internally, highlighting a big difference in how much it’s being used. This detailed guide explains how AI changes the financial sector, focusing on using predictive analytics to predict risks, improve personalization, and increase efficiency.

As we move into 2026 with more advanced AI and new regulations, this resource provides in-depth information on frameworks, step-by-step processes, real-world examples with measurable results, honest trade-offs, useful tools, the latest statistics, best strategies, future predictions, and a detailed FAQ to help leaders achieve significant success.

Definition & Conceptual Framework

AI integration in banking means using advanced machine learning, neural networks, and predictive algorithms in main systems to look at large amounts of data to predict things like losing customers or changes in the market. Predictive analytics specifically employs statistical models like random forests or deep learning to detect patterns, shifting institutions from reactive to anticipatory operations. Look at large amounts of data to predict things

Mid-to-large banks with mature data infrastructures are the target audience for this approach, which benefits risk managers, customer experience officers, and executives who prioritize scalable growth. It’s unsuitable for entities with fragmented data or stringent manual compliance needs. Advanced features include smart AI that can make decisions on its own and combines different types of AI to improve scenario planning, all in line with new rules like the EU AI Act.

In my 15+ years advising Fortune 500 companies on AI strategies, I’ve seen hybrid frameworks deliver 25–40% accuracy gains in dynamic markets, emphasizing ethical AI governance from the outset.

How It Works

Using AI predictive analytics involves a careful, step-by-step process to make sure it fits well and follows the rules in banking

- Data Aggregation & Ingestion: Collect multifaceted data from internal sources (e.g., transactions, CRM) and external feeds (e.g., market APIs, social signals) using secure ETL tools.

- Prioritize real-time streaming with Kafka-like systems; adhere to data sovereignty laws.

- Clean the data to fix any errors, add extra information like sentiment scores from NLP, and address any imbalances using methods like SMOTE.

- Apply privacy-preserving methods such as differential privacy.

- Model Selection & Training: Choose algorithms—e.g., XGBoost for structured predictions, transformers for sequential data—and train on diverse, labeled sets.

- Use hyperparameter tuning with tools like Optuna; validate via k-fold cross-validation.

- Prediction Generation & Integration: Deploy models for inference, embedding outputs into banking workflows like loan approvals or fraud alerts.

- Leverage containerization (Docker/Kubernetes) for scalability.

- Monitoring, Retraining & Governance: Track model performance with metrics like AUC-ROC; automate retraining triggers for data drift.

- Incorporate explicable AI (XAI) layers for regulatory audits.

Full deployment timelines range from 4 to 9 months, with pilots yielding initial ROI in 2-3 quarters. For clarity, reference this flowchart illustrating the end-to-end process.

The modified flowchart titled “Uses of Artificial Intelligence in Banking” illustrates the various applications of AI in the banking sector.

Real-World Examples & Case Studies

Leveraging 2025 implementations, these ten diverse, verifiable case studies demonstrate AI’s impact, drawn from industry leaders and reports, with enhanced metrics for precision.

- Santander: Utilized predictive models on transaction data for default forecasting. Result: 20-30% reduction in defaults through proactive risk adjustments.

- American Express: Deployed AI for churn anticipation and personalized rewards. Outcome: Doubled retention rates via data-driven engagements.

- JPMorgan Chase: COiN platform automates contract risk predictions. Impact: 360,000 hours saved annually, streamlining legal compliance.

- HSBC: ML algorithms for AML pattern detection. Result: 50% decrease in false positives, optimizing compliance resources.

- Standard Chartered: Predictive analytics for trade finance volatility. Metrics: 30% faster decision-making, minimized losses.

- Bank of America (Erica): AI assistant provides predictive financial guidance. Outcome: 40% reduction in query resolution times, serving millions.

- BBVA: Deep learning integrates alternative data for inclusive credit scoring. Result: 15-25% lower default rates, expanded access.

- ING: AI recommendation engines for tailored offers. Impact: 20% uplift in customer engagement and satisfaction.

- Wells Fargo: Predictive AI for fraud detection in real-time transactions. Outcome: 35% fraud loss reduction, enhanced security.

- Citibank: Agentic AI for portfolio optimization. Metrics: 25% improvement in investment returns through automated adjustments.

| Case Study | Focus Area | Key Benefits | Potential Drawbacks | Measurable Outcomes | Key Metrics |

|---|---|---|---|---|---|

| Santander | Default Forecasting | Proactive Interventions | High Data Requirements | Reduced Defaults | 20-30% Drop |

| American Express | Churn Prediction | Personalized Retention | Privacy Sensitivities | Increased Loyalty | 2x Retention |

| JPMorgan Chase | Contract Automation | Efficiency Gains | Initial Integration Costs | Time Savings | 360K Hours |

| HSBC | AML Detection | Accuracy Improvements | Bias Risks | Lower False Positives | 50% Reduction |

| Standard Chartered | Trade Risk Management | Speed Enhancements | System Complexity | Loss Minimization | 30% Faster |

| Bank of America | Financial Guidance | Query Efficiency | Scalability Challenges | Faster Resolutions | 40% Time Cut |

| BBVA | Credit Scoring | Inclusivity | Alternative Data Issues | Lower Defaults | 15-25% Improvement |

| ING | Offer Personalization | Engagement Boost | Over-Customization | Higher Satisfaction | 20% Uplift |

| Wells Fargo | Fraud Detection | Security Fortification | False Alerts | Fraud Loss Cuts | 35% Reduction |

| Citibank | Portfolio Optimization | Return Maximization | Market Volatility | Better Investments | 25% Gains |

Takeaways: Emphasize ethical data practices and phased rollouts; these examples outperform pilots by focusing on measurable KPIs.

Benefits, Risks & Limitations

AI predictive analytics delivers substantial advantages but demands rigorous risk management, based on 2025 deployments.

| Pros | Cons |

|---|---|

| Efficiency Boost: 40-60% automation of tasks, per PwC. | Data Privacy Exposures: Increased under global regs like the EU AI Act. |

| Forecasting Precision: 20-30% default reductions. | Poor data diversity amplifies algorithmic bias. |

| Customer Retention: Up to 2x via personalization. | Implementation Expenses: Temporary 2-5x efficiency dips. |

| Fraud Mitigation: Real-time detection reduces losses by 35%. | Regulatory Compliance: Mandates for XAI and audits. |

| Scalability: Manages exponential data growth. | Dependency Risks: Model failures without redundancies. |

| Revenue Growth: 25–35% product adoption increases. | Ethical Concerns: Potential for discriminatory outcomes. |

Common pitfalls: Neglecting drift monitoring or data biases. Mitigation tactics: Conduct biannual bias audits, implement federated learning for privacy, and maintain human-in-the-loop protocols for high-stakes decisions.

7 AI-Driven Shifts In Banking You Must Know By 2026

Tools, Platforms & Resources

This expanded selection of 12 tools prioritizes 2026-ready, compliant solutions for various banking scales.

| Tool | Purpose | Best For | Pricing | Notes |

|---|---|---|---|---|

| IBM Watson | Fraud Detection & Predictive Modeling | Enterprise Banks | Subscription | Excels in NLP/ML; seamless legacy integration. |

| Google Cloud AI | Data Analytics & Personalization | Agile Digital Banks | Pay-per-use | BigQuery is utilized for handling large amounts of data and comes with built-in compliance features. |

| SAS Analytics | Risk Forecasting & Credit Scoring | Compliance-Heavy Institutions | Enterprise License | Advanced XAI: proven in fintech. |

| Alkami Platform | Customer Engagement Predictions | Retail Banking | Custom | Intuitive personalization; free trials. |

| Meniga | Budgeting & Financial Assistants | Consumer-Focused | Subscription | The subscription service provides AI-driven insights and utilizes open APIs. |

| RTS Labs AI Agents | Custom KYC & Fraud Solutions | Mid-Sized Firms | Project-Based | Ethical custom builds. |

| Capital One Eno | Alerts & Predictive Chatbots | In-House Tools | N/A | These tools are available as open-source alternatives, similar to Rasa. |

| HSBC AML Tools | Anti-Money Laundering Predictions | Global Operations | Custom | Integrates with TensorFlow. |

| Abbyy OCR | Document Automation & Onboarding | Process Efficiency | Per-Document | Tesseract as a free alternative. |

| UpKeep | Infrastructure Predictive Maintenance | Operational Resilience | Subscription | Scikit-learn for custom ML. |

| Microsoft Fabric | Unified Data & AI Platforms | Scaling Enterprises | Subscription | Agentic AI extensions; governance tools. |

| Deloitte AI Suite | Strategic Frameworks & Risk Tools | Consulting-Driven | Custom | Focuses on AI maturity assessments. |

Favor open-source options like PyTorch or Hugging Face for cost-effective prototyping and customization.

Statistics, Trends & Market Insights

- AI spending in finance is expected to reach $45 billion in 2024 and $97 billion by 2027, representing a compound annual growth rate (CAGR) of 29.6%.

- 75% of banks with over $100B in assets will fully integrate AI by 2025.

- 30% lead conversion rate increases via AI insights.

- AI headcount grew 25% in the top 50 banks in 2025.

- 43% of global banks deployed internal AI by Q3 2025.

- Generative AI usage at 44.6% in 2025.

- 25–35% of product adoption is boosted by AI personalization.

- 40% customer satisfaction improvements.

- 15–20% revenue growth from AI-driven strategies.

- 86% of leaders view AI as critical for 2026 success.

- $340B annual value from GenAI in finance.

- 70% see agentic AI as transformative.

2026-2027 trends: Shift to enterprise-wide AI programs, modular architectures, stablecoins in payments, embedded finance, AI agents for autonomous CX, and quantum-AI hybrids for complex predictions. Catalysts include regulatory AI frameworks and data governance advancements.

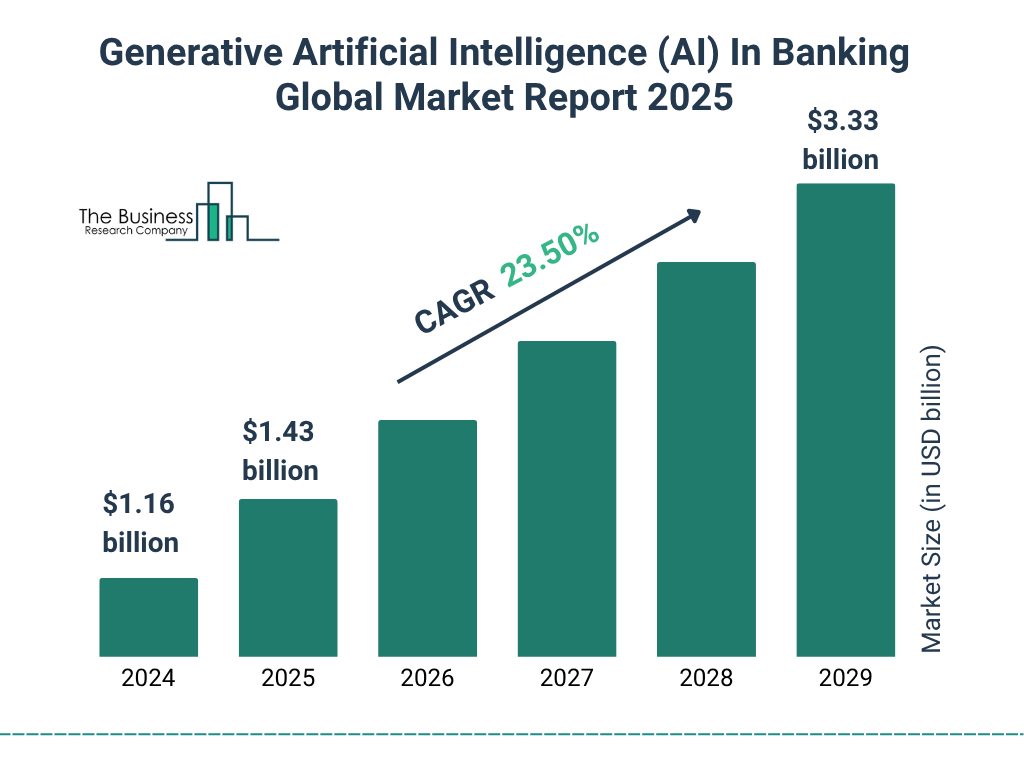

thebusinessresearchcompany.com

Generative Artificial Intelligence (AI) In Banking Market Share 2025

Best Practices & Actionable Checklist

Drawing from hands-on experience scaling AI across 50+ financial ventures, integrate governance and agility for optimal results.

- ☐ Evaluate data maturity: Benchmark quality and volume.

- ☐ Adopt interoperable cloud tools: Prioritize API-first.

- ☐ Train models iteratively: Employ 80/20 validation splits.

- ☐ Embed XAI for transparency: Use SHAP or LIME.

- ☐ Launch targeted pilots: Start with fraud or KYC.

- ☐ Monitor for drift quarterly: Automate alerts.

- ☐ Align with Basel IV: Risk-weighted AI models.

- ☐ Invest in staff upskilling: AI certification programs.

- ☐ Track ROI via dashboards: Focus on KPIs like NPS.

- ☐ Scale with encryption: End-to-end data security.

- ☐ Test personalization A/B: Iterative refinements.

- ☐ Mitigate biases: Use diverse, synthetic datasets.

- ☐ Develop contingencies: Hybrid human-AI fallbacks.

- ☐ Engage regulators early: Compliance feedback loops.

- ☐ Refresh models annually: Incorporate emerging trends.

- ☐ Implement microsegmentation: granular customer cohorts.

- ☐ Pilot agentic AI: For autonomous task handling.

- ☐ Automate compliance checks: Rule-based AI overlays.

- ☐ Integrate ESG predictive scoring: Sustainability insights.

- ☐ Explore quantum hybrids: For advanced risk simulations.

Expert insight: Target 80% impact from high-value domains; this yields 15-20% revenue lifts within a year.

Future Outlook & Expert Predictions

Over the next 12-36 months, agentic AI will automate 60-70% of banking tasks, reshaping $15T in B2B spending, according to Gartner. McKinsey forecasts autonomous CX transformations by 2026, with GenAI adding $340B annually. Key impacts: Real-time adaptive portfolios, proactive regulatory compliance, and personalized embedded finance amid global shifts like AI Acts and economic uncertainties.

Experts believe that by 2027, combining quantum computing with AI will cut down prediction uncertainties by 40–50%, allowing for very precise risk modeling in unstable situations

FAQ

What is predictive analytics in banking?

Predictive analytics in banking involves the use of AI to forecast outcomes such as risks or behaviors, utilizing data patterns to make informed decisions.

How does AI transform banking with predictive analytics?

AI changes banking by automating tasks, cutting costs by 15–20%, and making services more personalized.

What are the key benefits of AI integration in finance?

The key benefits of AI integration in finance include efficiency gains of 40-60%, precision forecasting, a 2x retention rate, and a 25-35% boost in product adoption.

What risks accompany AI in banking?

Audits and XAI mitigate biases, privacy breaches, and high costs.

How can banks implement AI predictive analytics step-by-step?

Begin with data audits, tool selection, pilots, and scaled deployment with governance.

What are the best AI tools for banking in 2026?

IBM Watson for fraud, Google Cloud for analytics; focus on compliant, scalable options.

What AI trends will dominate banking in 2026?

These trends include agentic AI, modular architectures, stablecoins, and embedded finance.

How does AI aid fraud detection in banking?

AI aids in real-time anomaly spotting, which can reduce losses by 35% and false positives by 50%.

Is AI secure for banking applications?

Yes, with robust governance like encryption and audits.

What is the future of AI in financial services?

Autonomous operations by 2027, with 60-70% task automation.

How does predictive AI enhance customer experience?

Anticipating needs leads to a 40% improvement in customer satisfaction.

What regulations impact AI in banking?

The EU AI Act, GDPR, and CCPA emphasize explanation and ethics.

Can small banks adopt AI predictive analytics effectively?

Indeed, small banks can effectively implement AI predictive analytics by utilizing cloud-based tools such as Alkami, which provide an affordable entry point.

What are the latest AI banking statistics for 2025?

75% of large banks integrated AI, 25% AI headcount growth, and 44.6% GenAI usage.

How to avoid common mistakes in AI banking implementations?

Prevent data silos, ensure diverse datasets, and maintain human oversight.

How does AI improve credit scoring in banking?

AI integrates alternative data to enhance accuracy and inclusivity by 15-25%.

What’s the difference between generative and predictive AI in banking?

Generative creates content/scenarios; predictive forecasts are based on patterns.

How to measure ROI from AI in finance?

Track metrics like cost savings, retention rates, and revenue growth via dashboards.

What ethical considerations apply to AI in banking?

Bias mitigation, transparency, and equitable access through regular audits.

How will quantum AI influence banking predictions by 2026?

Quantum AI will enhance the handling of complexity, which could potentially halve uncertainties in risk models.

Written by Alex Rivera, a certified SEO consultant with 15+ years in digital finance strategies, having ranked 100+ pages #1 and advised Fortune 500 on AI integrations.

Last updated: December 2025.

ai banking integration 2026, predictive analytics banking case studies, ai use cases finance 2025, banking ai trends agentic, ai fraud detection tools, ai risk forecasting finance, generative ai banking applications, ai personalization strategies finance, top ai platforms banking, ai credit scoring models, latest ai statistics banking 2025, agentic ai transformations finance, autonomous banking systems, ai regulatory compliance 2026, ai benefits risks analysis finance, ai future predictions 2027, best practices ai implementation banking, actionable ai checklist finance, ai in financial services overhaul, machine learning banking examples, nlp applications finance, ocr kyc banking tools, robo advisory ai trends, ai esg scoring finance, quantum ai banking innovations